As the insurance industry experience ongoing massive growth in the volume of data it needs to manage, AI-driven process automation can streamline operations, save time, enhance oversight, and improve the customer experience. Here's how.

Over the past few years, the insurance industry has experienced substantial growth in the volume of documents is needs to process throughout the client lifecycle

Due to variety of formats, companies are forced to use human intervention in many business processes. Most of the information received consist of unstructured data and depends on human labour to covert information received into "actionable" data.

This task is time consuming; insurance agents have to read, validate, enter, cross-check, communicate and then upgrade the information contained in the documents they handle.

Unleashing the potential of AI to process unstructured data

Unstructured data is data with no specific format or organisational structure. Formats include text, images, audio and video. It can be challenging to process, search, and analyze using conventional data processing tools

Due to the lack of consistent structure, it often required more advanced techniques, such as machine learning algorithms or Natural Language processing (NLP), to extract meaning and insights from the data.

Machine learning and NLP

Machine learning is about learning data - even small set - to make predictions, decisions and to automate. With machine learning, we no longer program a specific task, but build and algorithm that will then learn by itself based on the data that feeds it.

To do this, the algorithm breaks down the learning process into more manageable stages and subsequently merges the outcomes of each stage into a single output. When machine learning focuses on interactions between computers and human language, it is known as natural language processing (NLP).

There are now plenty of applications using NLP, such as chatbots that answer questions, GPT text generation, and Deepl translations. NLP is subset of machine learning - they both use trained algorithms to learn from data, but while machine learning covers many techniques and applications, NLP focuses on language-related tasks.

Information overload - the growing issue of data capture in the insurance industry

Transforming and translating data to be usable is one step, but the extraction of the preliminary data must be done first.

Data comes from diverse sources, and these can range from poorly organized to totally unstructured. Data extraction consolidates and refines those data to store in a centralisedlocation, waiting to be transformed.

The technique used for extraction will vary according to the source. Data coming from structured database may use SQL queries to retrieve the information, while Web Scraping would be used to retrieve data coming websites.

In the insurance industry, the amount of information is colossal - it will require all those different techniques to centralise data and make it usable for different departments.

So how can this be done in the most efficient way?

Using AI to optimise insurance industry processes

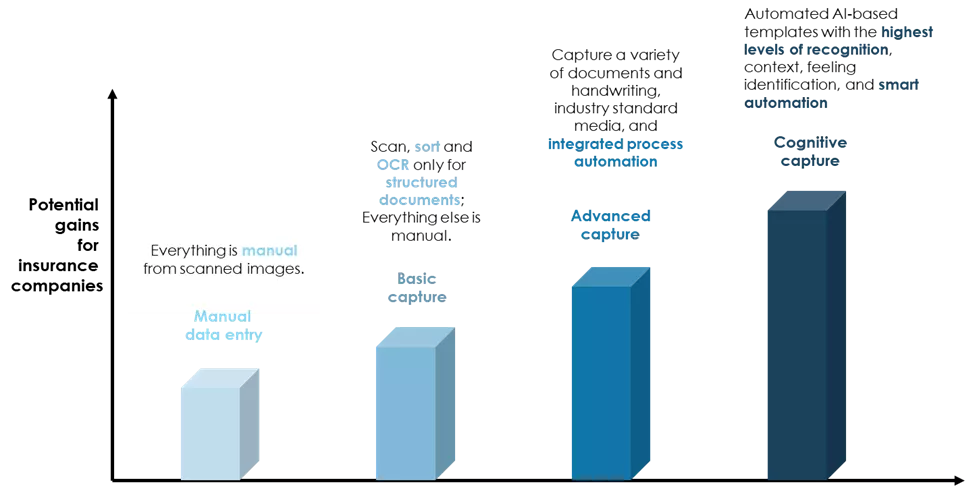

While data capturing is maturing rapidly, most companies are missing out on the technologicalk potential of AI. Companies can use AI technologies to improve their business development, while offering a seamless customer experience, reducing commercial friction in a mature market with few differentiating offers and a high customer acquisition cost.

When processes are manual, it leads to several challenges.

1. The first is the volume of data to be processed. Insurance companies deal with very large amounts of data, making data extraction a time-consuming process. Automation claim processes with AI improves productivity and reduces the time required to process claims, resulting in faster turnaround times.

2. Another challenge is the reception of data, which comes from different channels in multiple formats and is often low in quality. To address this, it is essential to consolidate data inputs from different sources into a a single centralised system.

Machine learning algorithms enable automatic data extraction from all kinds of sources, routing it through the appropriate path. This not only improves data accuracy, but also ensures that the same data is used throughout the company, streamlining informed decision-making and collaboration.

Saving time, answering questions and offering oversight: AI in the office

Once the data has been centralised in one place, it still needs to be redirected to the right services.

If the process is not automated, the service assignment requires human intervention since the services associated with a claim are identified and assigned semi-manually. This is where machine learning technologies come into play.

A classification model can be trained to predict who will be assigned a task or file based on enriched data. The services associated with the request are identified and automatically assigned to the bucket of the right request handler. Errors due to manual entry of information are reduced, as well as the time for a claim to arrive in the hands of the right person.

Similarly the implementation of chatbots enables customers get questions answered at any time and frees up time for claim handlers. It will reduce processing times and provide a better customer experience, leading to higher customer satisfaction levels.

Automation of processes using AI can improve several critical areas of operations. The potential benefits of AI for insurance companies are widespread.

- At a company level, insurance companies who automate their processes should save time in processing claims and reduce costs.

- At a market level, maximising the customer experience will enable insurance companies to maintain or even increase their customer base in a competitive and mature market.

- At a management level, oversight and control will be improved because information will be uniformly available in real time, enabling informed decision-making.

Unlock efficient optimised processes with AI: our support proposal

At Avertim, we understand the challenges that the insurance industry faces.

Our expertise and experience can help insurance companies to optmise their processes, creating significant reduction in turnaround times, cost savings and improved customer satisfaction.

We can help you to create a solution tailored to your specific needs.