Post COVID-19 aviation industry: is the sky the limit?

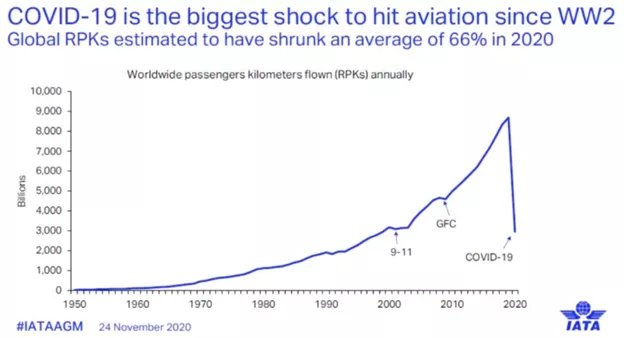

At the beginning of the COVID-19 pandemic (Q2 2020), the indirect impacts of this virus on the aviation sector were addressed whilst preparing for the restart of the airports activities. While many hoped for a slow recovery, the industry suffered new waves of restrictions. Time to do an update and look at the 2021 forecasts.

And with the good news of approved vaccines from various manufacturers, we are still preparing for a third wave. In short, unfortunately we have not yet gotten this over with and the future in the Aviation sector will remain very uncertain.

What opportunities may present themselves so that we can positively look forward to 2021 and beyond?

5 key factors should be put in place as a trigger for positive developments in the new year.

#1Manage operations in an efficient way whilst restoring passenger trust.

#2 Continue building your commercial strategy & brand even during uncertain times.

#3 Negotiate special concessions with governments and valued partners.

#4 Pursue Technology development.

#5 Diversify the activity to different revenue streams.

Aviation sector & global economic growth

Aviation industry has become one of the most important sectors of industry that contribute to the global economic growth. Brussels Airport (BAC) for instance is contributing to the Belgian economy with a pool of 60,000 employees covering different type of jobs such as direct employment of aircrew, airport operators, airlines, air navigation service providers and indirect employment too such as fuel suppliers, construction companies, aircraft companies’ suppliers and many others.

The current COVID-19 crisis is still hitting the Aviation sector hard: while the airlines did stop flying due to significant decrease of passenger demand, the airport operator does not have many choices rather tha maintaining their operations to facilitate important movement such as repatriation and cargo flights. Moreover, at the same time the airport needs to support airlines by providing certain area to use as new aircraft parking positions.

From a revenue perspective

From a revenue perspective, landing fee and passenger facility fees as well as other aeronautical and non-aeronautical revenues are the main source of income airports. For the past few months, airports have been operating near a zero-revenue environment that has negatively impacted the ability to generate cash and preserve liquidity. Fixed costs of an airport expenditure remain intact while other airport COVID-19 associated costs have continued growing. A few examples of associated costs are facility disinfection, cleaning costs, installation of protective barriers at counters and investments in touchless or low touch technologies. So, whereas an airport can choose to postpone or cancel CAPEX, the OPEX costs of an airport needs to be maintained for the minimum operations and with the current passenger traffic (-80-90% as compared to last year), Brussels Airport is losing € 1 mio per day.

'Back to normal' ?

'Back to normal' will may be never be the same than before. If we make a distinction between Business Travel and Leisure travel, it is most likely that Business Travel will not reach its pre-COVID-19 traffic numbers as it has become clear that homeworking and setting up meetings via Zoom and Teams can perfectly replace most of the physical meetings, except may be diplomacy meetings and negotiations. But why organizing a 2-hour Steerco meeting in Brussels, where colleagues will fly in from UK, Spain, Italy and the Hungary? Not to mention the overnight stays… As far as leisure travel is concerned, what will be the impact on travel prices? Will low cost exist and wouldn’t air travelling become just a possibility for the elites? Whatever the long-term trend will be, all the aviation resources talk about a recovery period of 4-5 years.

How can airports be resilient and flexible enough to get out of this crisis?

5 key factors should be put in place as a trigger for positive developments in the new year:

#1Manage operations in an efficient way whilst restoring passenger trust

>The end goal is to keep the airport open but with limited services to reduce overall cost. This initiative can help not only airports but also partners (for example ground handlers) to reduce night shift personnel costs. To execute a successful bare minimum cost operation while still be able to provide safe operations, airports should review all commercial scheduled flight itineraries as well as cargo, medevac, charter, humanitarian, and military activities. In terms of managing the operations in the most efficient way the Airport Operations Center will play a key role by aligning the stakeholders in these uncertain circumstances and ensuring that just the necessary resources are available.

> Having the operations run in the most efficient way will be the condition to start gaining trust with the passengers to travel. Airports are subject to (international) travel measures and those limits must put the passenger at ease and guarantee that the traveler can enjoy his / her trip without stress. That is the moment where passengers also start spending at the airport again, which is crucial for shops and airport income.

#2 Continue building your commercial strategy & brand even during uncertain times

> Nowdays, the concepts of safety, sanitation, corporate responsibility, and sustainability are perceived by passengers’ as important top-of-mind awareness. Therefore, we have to focus on building and engaging your target audience with those in mind while satisfying your customers before the competitor does and stimulating future demand.

> To offer more value, airports should concentrate on loyalty programs, strategic pricing, and partnerships with employees/communities/governments/tourism associations and chambers of commerce. Airport retail partners should focus efforts on promotional vouchers, instant discounts, and return passenger vouchers targeting their next purchase.

> During and beyond COVID-19 times, airports should expand target groups to include non-travelers and arrival passengers while diversifying distribution channels. Reviewing communication (both internal and external) and media strategies is essential. What airports do today will continue to define their brands and market positioning in the months or years to come. Airports need to use this opportunity wisely to tap into new sources of revenue, lower sales channels cost, and further build their brands.

#3 Negotiate special concessions with governments and valued partners

> Any government relief package must focus on targeting the entire air transportation ecosystem including airports and its valued partners such as airport retail tenants, restaurants, lounges, airport offices, car rental, and parking operators – among others. Airports should evaluate directly with airport tenants what win-win strategy can be executed in terms of rent adjustments, rent deferrals, and contract extensions.

#4 Pursue Technology development

> It is expected that touchless technology will accelerate in the near future including touchless biometrics to verify passenger identity (e.g. Facial recognition). It will help to reduce waiting times while improving passenger experience. Wi-Fi opportunities and its touchless in-flight interaction are expected to be further deployed by several airlines. In terms of e/Mobile-commerce world, both airports and airlines need to start working closely together to boost retailing opportunities.

>Innovation, data exchange and digital cooperation between airlines and airports needs to occur if both want to maximize revenue per passenger. The APOC will remain an important ‘actor’ in materializing this synergy amongst the key stakeholders.

> In today’s cost cutting environment, many experts are discussing what role innovation teams play and will play in the coming months to rebuild travel confidence and improve the end-to-end travel journey. Technology, automatization, and innovation will play a key role to relaunch operations and differentiate one airport offer from another. Additional and upcoming innovation ideas and solutions will need to be developed, tested, and implemented. To meet the future demands and the current ones due to COVID, innovation thinking teams are a key resource to keep and hire.

#5 Diversify the activity to different revenue streams

In the 2040 vision of Brussels Airport, established in 2016, has the strong ambition to diversify its sources of revenue streams. In 2019 this project became reality with the launch of Brussels Airport Consulting and the start of Corporate Ventures. This trend will be further pushed amongst (International) airports due to the COVID-19 pandemic as the aviation revenues have come to a halt. Investments in airport cities (a centrer on a human scale for passengers, visitors and for the surroundings), creating Joint-Ventures to sell capabilities to other sectors, set-up partnerships to sell consulting services should be further explored as potential new revenue streams. With the current boost of e-commerce activities and the distribution of the vaccine, airports should develop both the cargo area and the area around the airport terminal expand into a corporate eco-system, that will, in turn, create more jobs.

Conclusion

Focusing in parallel on the operational excellence, marketing activities and technology developments on a step-by-step basis will be key for airports to recover from the pandemic. In addition, the trigger to diversify towards other aviation activities is now, and so this will be a balancing act between (potential) revenues in the short term and cost control. It will also require other reporting elements and dashboards towards C-level at the airports.

Given Avertim’s extensive experience in the transport sector,

and more precisely in the aviation sector, 2 potential support roles we can play in the short term to help airports to recover:

Written by

- Bart S., Strategic Director, Avertim