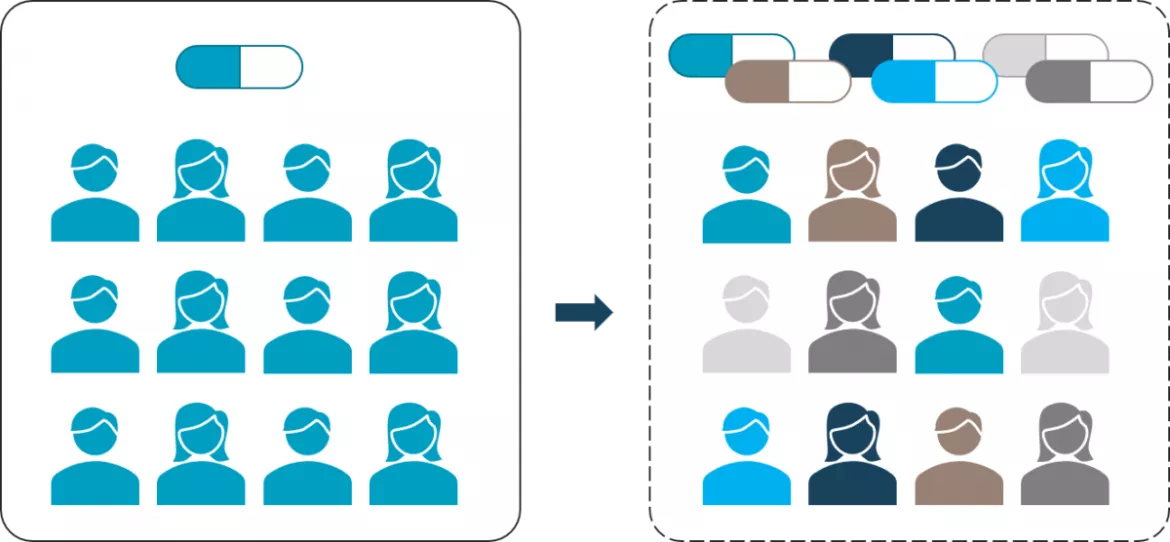

Is the traditional « One size fits all » blockbuster model dying?

"One size fits all" has long been the norm in the world of medicine. Pharmaceutical companies have long made high profits thanks to the standard approach of the same drug for all patients. But, given the fact that the pharmaceutical industry is under enormous pressure the healthcare sector as well as this traditional approach are currently being revolutionized, with several factors contributing to the demise of the traditional blockbuster model such as the growth of personalized medicine. Let’s have a look backstage.

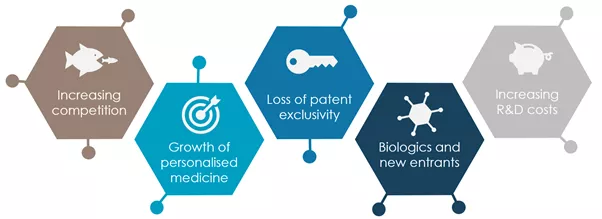

5 main reasons why the pharmaceutical industry is diverting from the “one size fits all” blockbuster model

The business model of the pharmaceutical industry generally pursues a population-based approach towards therapy, assuming that patients with the same diagnosis will respond similarly to the drug (the “one size fits all”). However, the larger the target group, the greater the potential for competing companies to offer therapies in the self-same group. As a result, there is increasing predatory competition among manufacturers, with corresponding losses of market share. Pharmaceutical companies therefore need to differentiate themselves by developing and distributing more specialized drugs and treatments.

Particularly affected are products that have lost their patent exclusivity and are subject to the competition of drugs that contain the same pharmaceutical active chemical substance, called “generics”. Since the only way to generate a return is through volume, markets are being flooded with low-priced generics. Some studies forecast that over $250 billion of global sales are at risk due to patent expiries between 2020 and 2026. New strategies have to be developed to stop the cost leadership of generic manufacturers.

One example is the combination of therapy and diagnostics, such as in the case of personalized medicine. Here, the aim is to address smaller target groups in specialised markets to differentiate with narrower areas of attack or to diversify into innovation. As explained by the FDA, “personalized medicine aims to streamline clinical decision making by using biological information available through a genetic test or biomarker, and then saying, "based on this profile, I think you're more likely to respond to Drug A or Drug B, or less likely to have an adverse reaction with Drug C”. There are many reasons justifying the growth of personalized medicine: advance of biotechnologies, analytics, diagnostics, changes in healthcare financing and regulations to focus more on the effective outcomes, etc. This revolutionary approach to patient care is definitely here to stay and far away from the traditional “one size fits all” model.

Biotechnology as springs for new products have become more important than ever before. The space for small molecules, once the core of big pharmaceutical companies, has reached its limits. Research in the field of biologics- drugs produced from living organisms - is growing rapidly as it represents the most promising category of new drugs in the 21st century. Biologics include game-changing immuno-oncology and gene therapies, but also treatments available for years, such as insulins, haemophilia, drugs for rheumatoid arthritis, multiple sclerosis and cancers. The number of biologics registered worldwide has increased more than three hundredfold. The global biologics market is expected to increase from USD 236 billion in 2017 to nearly USD 310 billion in 2023, growing at a compound annual growth rate (CAGR)of 4.69%. In 2020, the US Food and Drug Administration’s (FDA) Center for Drug Evaluation and Research (CDER) approved 53 new molecular entities (NMEs), of which 13 (or 25%) were biologics. This shows that the industry is turning eyes to new markets with higher added-value and potential for profit. If it is shaping traditional markets, it is also creating new types of “blockbusters”. Among the top 10 selling drugs projected for 2021, five are biologics. In 2021, AbbVie’s monoclonal antibody medication Humira (Adalimumab) is projected to be the industry’s top-selling drug (over $20B) with Merck & Co.’s Keytruda forecast as the second top-selling drug in 2021.

Clinical trials are becoming increasingly more complex and larger in size to meet payer demands for comparative efficacy data, resulting in subsequent higher costs, above the increasing safety and compliance requirements. As a result, R&D productivity has been declining gradually since the mid-1990s. The average costs per new molecular entity were approximately USD 2.5 billion in 2017. Industry expenditures have more than doubled within ten years. A reason for high costs is that only 13.8% of the active drugs tested in clinical trials are finally approved (ACSH). There are multiple systematic analyses of the causes for the failure of drug candidates up to phase 2 of clinical trials. Approximately 50% fail due to a lack of efficacy, or sometimes because they can’t prove a higher efficacy or differentiation to existing drugs on the market. But the most prevalent cause of lack of efficacy is not the drug itself, but the failure to relate the disease to the biological target. In order to increase R&D productivity, pharmaceutical companies are moving towards omics technologies – a catch-all term for various fields like genomics, lipidomics, proteomics, glycomics and others. One strong area of focus is human genetic data and analysis. On the one hand, the price of human genome sequencing has dropped exponentially from USD 3 billion in 2001 to less than $1,000 in 2016. This has led to rapid growth in the market for genetic testing in recent years. More than 70,000 unique genetic testing products are currently on the market, with an average of 10 new products being added each day. On the other hand, human genetic data, in turn, may increase the cumulative probability of success from clinical phase 1 to approval from 12% to 28% through the reduction of target-related efficacy risk and consequently cut the cost of developing a new drug by about 46%.

So, what do these trends mean for pharmaceutical manufacturing and industrial operations?

Avertim has a strong foothold in key European Life Sciences markets especially in the areas of manufacturing, process, supply chain operations and regulatory compliance for pharmaceutical companies. Our clients are feeling these industry trends and have the will to adapt their technologies and operational capabilities accordingly:

> Small batch manufacturing: personalized medicine and targeted therapies have the potential for disruptive innovation for the pharmaceutical industry. This is creating the need for more flexibility on fill-finish lines, thereby enabling efficient small batch production of drugs in more specialized facilities. Manufacturers also need more flexibility in availability of primary packaging components, especially in small volumes. This can be a challenge for costs since the same GMP validation and compliance activities are required as in any other. It can also create increased supply chain complexity. “One batch for a few patients” also means more transportation hurdles from the manufacturing site to patients, since not every material can be frozen for safe transport or to prolong the shelf-life.

> Faster time-to-market: in a context of increased competition, decreasing number of patents, shorter drug life-cycles, the rise of generics and increased payers’ pressure, it is becoming clear that pharmaceutical companies are generating most of the profit margins in the first years of new product introductions. Key factors for them – similarly to what we have seen with COVID-19 vaccines – will be a faster technology transfers from R&D to manufacturing as well as faster scale-up of production. This can be made possible thanks to smooth processes, fast-track programs and digital technologies facilitating data collection, assessment, and compliance.

> Data research: as omicstechnologies (described above) become more widespread, cost-effective and increasingly important, many more patients could have some biological samples tested in the future. Consequently, the pharmaceutical industry needs not only to decide which specific bio analytical tools and assays to use, but also to find ways to expand data and analytics capabilities for the storage and evaluation of new data volumes. Since the pharmaceutical industry is particularly lacking in the three dimensions of data collection, data analysis, and analytics-based decision making, major investments are needed in bioinformatics, biomathematics, and biostatistics.

> Diagnostics: in the case of personalized medicines, having the right diagnostics and devices to find the right patient for the drug will become increasingly important. These diagnostics make sure that the right drug is delivered to the right patient. Pharmaceutical companies will have to either create relationships with existing companies focusing on such tools (diagnostics manufacturers) or build this capability in-house dependent on their existing assets and strategies.

> Investment in novel bioprocess technologies: the manufacturing of novel biopharmaceuticals can often times be more complex than that of medicines that are accessible through chemical pathways. To make the transition process from classical chemical or biotechnological to novel bioprocess technologies, pharmaceutical companies have to invest in new facilities and bio processing equipment: cell lines, harvesting, purification or treatment of the finished product. One area of focus is in flow or continuous manufacturing in opposition to the fed-batch manufacturing processes that are still widespread. In batch manufacturing, a specific quantity (or batch) of a drug is produced, production is stopped, then samples are tested offline for quality. In continuous manufacturing, pharmaceuticals are moving non-stop through the facility with low to no holding times between steps. Everything is integrated and quality is tested by in-process controls. This will lower capital and operating cost, increase robustness and enable a better time-to-market. Another trend we observe is the replacement of stainless-steel equipment for single-use technologies (bags, tubes, sterilization, cleaning systems) within the manufacturing process. Effectively eliminating large parts of the previously necessary effort for cleaning and cleaning validation. This will again increase flexibility and reduce manufacturing costs even more.

Conclusion

The shift of small molecules before 2010, to biopharmaceuticals from 2010 to 2020 continued with a trend towards personalized medicine after 2020. Instead of continuing old-school “one size fits all” blockbuster models, winning pharmaceutical companies of the future will be the ones shifting to more modern personalized drugs and treatments, by inventing new models and patient pathways and harvesting the potential of data through digital technologies. A pharmaceutical landscape where players cooperate more closely together is needed to find an efficient way to design a process that will enable commercialization of such therapies. The availability and maturity of specialized equipment to furnish such facilities and enable new manufacturing processes relies on the willingness of companies to drive innovation. The willingness to utilize digital tools in their existing processes will enable pharmaceutical companies to understand the needs of tomorrow and set them on a journey to enhanced patient care and competitiveness.

Written by

- Lucas Z., Business Manager, Life Sciences industry

- Stanislaus K., Business Manager, Life Sciences industry

Want to know more about us?

Learn more about Avertim Life Sciences

Interested to harvest digital potential in the Pharmaceutical?

Our whitepaper may interest you!